目录:

Catalogue:

1,什么是私募股权投资

1,What is the Private Equity Investment

2,私募股权投资收益率表格

2,ROI Form of Private Equity Investment

3,公司简介

3,Company Profile

4,房地产基金计划投资的项目

4,Projects To Be Invested In

5,公司过去\现在\未来房地产开发项目投资计划时间表

5,Investment Plan Schedule of Company’s Past/Present/Future Real Estate Development Projects

6,集团市场价值和房地产私募股权基金发行

6,Group Market Value and Realty Private Equity Fund Issuing

7,投资风险及投资风险控制

7,Investment Risks and Risks Control

8,私募股权投资人与控股人的责任与权力

8,Responsibilities and Powers of Private Equity Investors and Shareholders

9,房地产基金投资风险评估

9,Investment Risk Assessment of Realty Fund

10,房地产基金融资金额和资金用途

10,Financing Amount and Purpose of Realty Fund

11,投资人需知及投资流程

11,Note for Investors and Investment Process

12,投资协议书

12,Investment Agreement

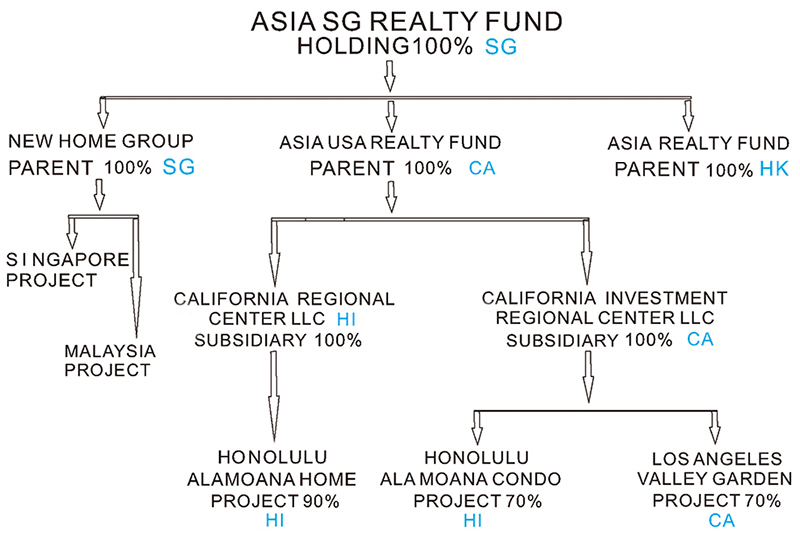

13,公司组织架构图

13,Company Organization Chart

1,什么是私募股权投资?

1,What is the Private Equity Investment?

1-1,私募股权投资,是非上市公司通过出售转让公司股权方式融资,有符合条件的个人和投资机构,将资金投资到需要资金的公司,发展公司业务,这样的方式叫私募股权投资方式。

1-1,Private equity investment refers to the non-listed companies raise

financing by selling and transferring the equity of the company.

Qualified individuals and investment institutions will invest the funds

in the companies in need of funds and develop the company's business.

This way is called the private equity investment.

1-2, 新加坡跟美国一样,如果公司是出售转让自己股份融资的,无需向政府金融管理部门申请许可证,是豁免的;如果基金公司是作为经纪人管理第三方投资人的资金,或者公开发行房地产投资信托基金的,则需要向政府金融管理部门申请许可证。

1-2, In Singapore, as in the United States, if a company sells its own

equity for financing, it is exempt from having to apply for a license

from the government financial authority. If a fund company manages the

funds from third-party investors as a broker, or publicly issues the

real estate investment trusts, it needs to apply for a license from the

government financial authority.

1-3, 私募股权投资是非常直接的投资方式。符合条件的投资人可以直接跟需要资金的公司签约,投资人无需支付投资管理手续费,无需支付第三方机构佣金。

1-3, Private equity investment is a very direct way of investment.

Qualified investors can directly sign contracts with companies in need

of funds, without paying investment management fees or commissions to

third-party institutions.

1-4,亚洲新加坡房地产基金的私募股权投资是一个投资灵活、投资金额门槛低、投资收益率高、有固定收益的房地产私募股权投资方案。

1-4, The private equity investment of Asia SG Realty Fund is a flexible

investment program with low initial investment threshold and high &

fixed ROI.

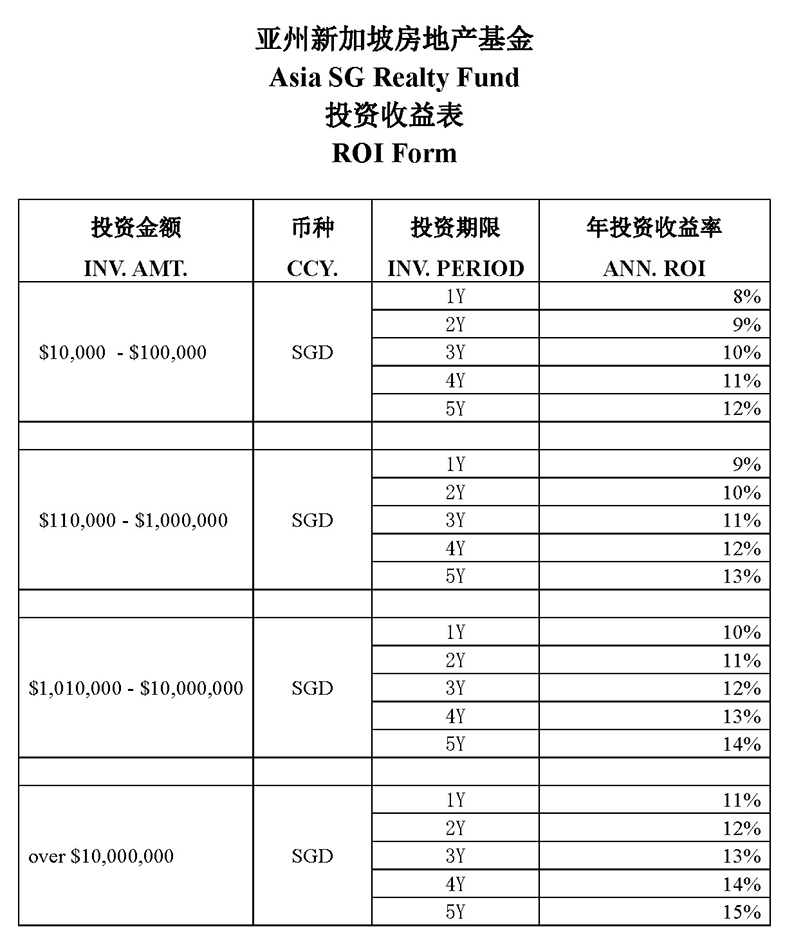

2,私募股权投资收益率表格

2,ROI Form of Private Equity Investment

3,公司简介

3,Company Profile

3-1,亚洲新加坡房地产基金是一家房地产项目投资的基金公司,公司主要经营项目:房地产项目投资,房地产投资管理,房地产项目融资,本公司帮助符合条件的投资人将资金直接投资到房地产项目中,帮助符合条件的合格投资的资金控制投资风险,从而获得固定的年投资收益,选择投资风险小的房地产项目。

3-1,Asia SG Realty Fund is a fund company for real estate projects

investment, which mainly engaged in real estate project investment,

management, and project financing. The company helps qualified investors

directly invest their funds in real estate projects, control

corresponding investment risks and choose projects with low investment

risks, so as to give a fixed annual investment income.

3-2,亚洲新加坡房地产基金已经与美国房地产建筑工程集团合作投资了很多房地产项目,包括:洛杉矶假日酒店项目,洛杉矶长滩项目,夏威夷房地产开发项目。详见WWW.USAFW.COM

3-2,Asia SG Realty Fund has cooperated with USA Realty Construction

Group Inc to invest in many real estate projects, including: Los Angeles

Holiday Inn project, Long Beach Garden Home project, Hawaii Real Estate

projects. See www.usafw.com for detail.

3-3,亚洲新加坡房地产基金融资后的资金专门用于投资房地产开发项目。虽然房地产项目投资不是暴利,但比较稳定且风险小。如果你希望得到稳定的投资收益又不想有太多投资风险,欢迎将你投资到我们亚洲新加坡房地产基金,这将是你的正确选择。

3-3,The funds raised by the Asia SG Realty Fund are specifically used

to invest in real estate development projects. The real estate project

investment is not profiteering, but relatively stable and small risk. If

you want to get stable investment return with small risks, then welcome

to invest in our Asia SG Realty Fund, which will be the right choice

for you.

3-4,过去 20 年,亚洲新加坡房地产基金在中国也投资了很多房地产开发项目。我们分别在中国香港、新加坡、马来西亚都有房地产基金公司,为喜欢投资房地产项目的投资人,投资和管理资金。

3-4 ,Asia SG Realty Fund has also invested in many real estate

development projects in China over the past two decades. We founded fund

branches in Hong Kong, Singapore and Malaysia, to help investors invest

and manage funds for real estate projects.

3-5,投资方式

3-5,Investment Methods

3-5-1,固定年度投资收益率方式;

3-5-1,Fixed Annual ROI

A, 股权方式;

A, Equity Method;

B, 贷款方式;(适合一次性向项目提供资金的投资机构或者投资人)

B, Loan Method (suitable for investment institutions or investors to provide one-time funds to the project);

3-6 ,投资收益:年度投资收益率或者利息 8%-15%;

3-6,The annual ROI or interest is 8% - 15%.

3-7,具体项目和投资相关信息,请浏览我们的网站 www.asia-fund.com,您可以通过电子邮件、电话咨询咨询我们,或“在线留言”栏目填写电子表格。

3-7, For the specific information related to projects and investments,

please visit our website www.asia-fund.com. You can consult us by email

or phone, or filling out an electronic form in the "online message".

4. 房地产基金计划投资的项目:

4. Projects To Be Invested In:

4-1, 夏威夷檀香山 40 层高级公寓楼项目

4-1, A 40-story Senior Condo in Honolulu, Hawaii

项目地址:夏威夷檀香山。

Project Address: Honolulu, Hawaii.

项目总投资:2 亿 5000 万美金。

Total Project Investment: $250 million.

项目税后利润:8000 万美金。

Project Profit (after-tax): $80 million.

项目投资规模:320 个单位

CONDO

Project Investment Scale: 320 units of CONDO

项目更多信息:

For more information of the project: www.alamoana-home.com

项目投资进度:

Project investment schedule:

2016 年-2023 年前期已经投资费用:5000 万美金。

Early invested expenses from 2016 to 2023: $50 million.

2019 年完成规划批准。

The planning was approval in 2019.

2022 年删除酒店重新规划。

The hotel planned of the project was deleted and re-planned in 2022.

2023 年 12 月份之前开工。

The construction is expected to start by December 2023.

2026 年 12 月份建成。

The project is expected to be completed in December 2026.

4-2, 夏威夷檀香山 26 层高级公寓项目

4-2, A 26-story Senior Condo in Honolulu, Hawaii

项目地址:夏威夷檀香山。

Project Address: Honolulu, Hawaii.

项目总投资:1 亿 2000 万美金。

Total Project Investment: $120 million.

项目税后利润:3000 万美金。

Project Profit (after-tax): $30 million.

项目投资规模:184 个单位

CONDO

Project Investment Scale: 184 units of CONDO

项目投资进度:

Project investment schedule:

2016 年-2023 年前期已经投资费用:4500 万美金。

Early invested expenses from 2016 to 2023: $45 million.

2019 年完成规划批准和施工许可证。

The planning and builder’s licence was approved in 2019.

2023 年 8 月份之前开工。

The construction is expected to start by August 2023.

2026 年 8 月份建成。

The project is expected to be completed in August 2026.

项目更多信息:

For more information of the project: www.alamoana-condo.com

4-3, 洛杉矶长滩家园项目:

4-3, Long Beach Garden Home project:

项目已经完成。项目更多信息:

The project has been completed. For more information of the project: www.longbeachgardenhome.com

4-4 , 洛杉矶万丽花园项目:

4-4 ,LA Valley Garden project:

项目地址:洛杉矶华人社区 VALLEY BLVD。

Project Address: Valley Blvd., LA.

项目总投资:1600 万美金。

Total Project Investment: $16 million

项目税后利润:400 万美金。

Project Profit (after-tax): $4 million.

项目投资规模:27 个单位

TOWN HOUSE

Project Investment Scale: 27 units of Town House

项目投资进度:

Project investment schedule:

2016 年-2023 年前期已经投资费用:500 万美金。

Early invested expenses from 2016 to 2023: $5 million.

2022 年完成规划批准。

The planning was approved in 2022.

2023 年 6 月份之前开工。

The construction is expected to start by June 2023.

2025 年 6 月份建成。

The project is expected to be completed in June 2025.

项目更多信息:

For more information of the project: www.usafw.com

5,公司过去\现在\未来房地产开发项目投资计划时间表

5,Investment Plan Schedule of Company’s Past/Present/Future Real Estate Development Projects

5-1,公司 1994 年-2004 年在中国市场投资房地产开发项目。

5-1,The company invested in real estate development projects in Chinese market from 1994 to 2004.

5-2 , 集团 2004 年在香港建立母公司 HK.ASIA-FUND.COM,同时进入美国市场投资房地产开发项目。可以通过网站浏览过去开发项目:www.usafw.com

5-2,The group established its parent company (hk.asia-fund.com) in Hong

Kong in 2004 and entered in USA market to invest in real estate

development projects. You can browse past development projects through

the website: www.usafw.com

5-3,公司计划 2022 年-2026 年完成美国项目投资。

5-3,The company plans to complete the projects invested in USA from 2022 to 2026.

这是目前正在投资中的美国项目:

The following projects are currently under investment in the U.S.:

ALA MOANA HOME 阿拉莫那家园

www.alamoana-home.com

ALA MOANA CONDO 阿拉莫那公寓

www.alamoana-condo.com

LONG BEACH GARDEN HOME 洛杉矶长滩家园

www.longbeachgardenhome.com

LA VALLEY GARDEN 洛杉矶万丽花园

www.usafw.com

5-4,公司已经从 2021 年开始在亚洲投资布局,集团计划从 2022 年开始陆续在新加坡市场和马来西亚槟城市场投资房地产开发项目。

5-4,The company has started to invest in Asia since 2021. The group

plans to invest in real estate development projects in Singapore and

Penang, Malaysia from 2022.

5-5 , 亚洲新加坡房地产基金是新家集团100%投资控股的新加坡母公司。新家

集团旗下有 3 个房地产基金公司,亚洲新加坡房地产基金作为母公司是专门为旗下子公司的房地产开发项目融资。

5-5, Asia SG

Real Realty Fund is the Singapore parent company of New Home Group with

100% investment holding. There are 3 realty fund companies under New

Home Group, and as the parent company, the Asia SG Real Realty Fund

specializes in financing for the real estate development projects of its

subsidiaries. the real estate development projects of its subsidiaries.

新家集团在新加坡登记注册,新家集团是全球总部控股公司。

New Home Group is incorporated in Singapore and is the global headquarters holding company.

新加坡、马来西亚、香港的投资计划,请访问:

The investment plan in Singapore, Malaysia and Hong Kong, please visit: www.new99home.com

6,集团市场价值和房地产私募股权基金发行

6,Group Market Value and Realty Private Equity Fund Issuing

6-1,集团市场价值。集团市场价值主要来源于新加坡总部控股集团旗下项目公司资产和完成投资开发投资后的市场价值。 6-1,Market value of the Group. The market value of the Group mainly comes from the assets of the project companies under the Singapore headquarters and the market value after the completion of investment and development.

目前集团旗下项目建成后的市场价值 5 亿 2000 万美金。其中包括:

At present, the market value of the projects after completion under the Group is expected to be USD $520 million, including:

夏威夷檀香山项目和洛杉矶项目:

Projects in Honolulu, Hawaii and Los Angeles, CA:

ALAMOANA HOME www.alamoana-home.com

|

总投资金额 |

项目销售收入 |

项目税后利润 |

|

2亿3000万美金 |

3亿3000万 |

7000万 |

ALAMOANA CONDO www.alamoana-condo.com

|

总投资金额 |

项目销售收入 |

项目税后利润 |

|

1亿3000万美金 |

1亿7000万 |

2800万 |

|

总投资金额 |

项目销售收入 |

项目税后利润 |

|

1400万美金 |

2000万 |

400万 |

6-2 , 以上 3 个项目已经完成前期投资,购买土地,规划,施工图设计,拆除旧建筑物,土地平整,施工许可证批准,现在只需要通过房地产私募股权融资建筑工程费用、项目管理费用和贷款利息。合计 2 亿 2000 万美金的融资, 可以完成以上项目的投资。

6-2 ,The above three projects have completed the initial investment,

land purchase, planning, construction drawing design, demolition of old

buildings, land leveling, and construction permit approval. Now only the

construction costs, project management costs and loan interest need to

be financed through real estate private equity that with a total

financing of USD $220 million, the above projects can be completed.

6-3 ,我们计划出售不超过 5 亿 1800 万美金市场价值的 20%,最多销售亚洲新

加坡房地产基金 1 亿美金股权的市值。按照 1 美金兑换 1.38 SGD 计算,发行

不超过 1 亿 3800 万股权的股份,5 亿 1800 万美金市场价值等于 7 亿 1484 万

SGD 市场价值。

6-3 ,We plan to sell no more than 20% of the market value

of USD $518 million (after projects completed) that maximum sale of USD

$100 million of equity market value in ASIA SG REALTY FUND. Based on the

exchange rate of USD $1 to SGD $1.38, no more than 138 million equity

shares will be issued, and the $518 million USD market value is equal to

the $714.84 million SGD market value.

6-4 , 我们会发行 7 亿 1484 万股份,投资人每投资 1 新加坡币 SGD 将拥有 1

股。

6-4 ,We will issue 714.84 million shares, and investors will own one share for every SGD $ 1 invested.

6-5 , 我们需要合格的投资人,符合条件的投资人,我们给予最低投资门槛金

额 1 万新加坡币起。

6-5 ,We need qualified investors, and for qualified investors we will offer a minimum investment threshold from SGD $10,000.

6-6 ,未来股权价值升值的机会:

6-6,Opportunities for future equity value appreciation:

由于集团战略性转移,未来将陆续在新加坡和马来西亚投资房地产开发项目,投资人的股权价值将有升值机会。

Due to the strategic transfer, the Group will continue to invest in real

estate development projects in Singapore and Malaysia in the future, so

that investors will have an opportunity to appreciate their equity

value.

7, 投资风险及投资风险控制

7, Investment Risks and Risks Control

7-1, 我们建议投资人选择表格中的固定投资收益率, 年度投资收益率

8%-15%,投资时间越长且投资金额越多,投资收益率越高。

7-1,We suggest that investors choose

the fixed ROI in the form, with an annual ROI of 8% -15%. The longer the

investment time and the more the investment amount, the higher the ROI.

7-2, 对于股权投资方式,投资人可以选择固定投资收益,也可以选择按照股权分配的年度投资收益,但后者存在一定的潜在投资风险。我们建议如果不想承担投资风险,应选择固定的投资收益。

7-2,For the equity investment method, the investors can choose fixed

investment income or annual investment income distributed according to

equity, but the latter has some potential investment risks. We suggest

that if the investors who do not want to assume the investment risks

should choose a fixed investment income.

7-3 ,投资人也可以灵活选择投资收益率方式,如果投资时间超过 3 年,投资人可以同时选择两种计算投资收益率的方式,如下:

7-3 ,The investors can also choose the ROI method flexibly. If the

investment time is more than 3 years, the investors can choose two

methods of calculating the ROI at the same time, as follows:

7-3-1 , 在股权年度分红的投资收益率比固定投资收益率高的时候,投资人可以选择按照股权比例分红获得投资收益。

When the annual ROI of equity dividends is higher than the fixed ROI,

the investors can choose to obtain investment return in proportion to

equity dividends.

7-3-2 , 在股权年度分红的投资收益率比固定投资收益率低的时候,投资人可以选择固定投资收益。股权实际只用于避免投资人承担风险。

When the annual ROI of equity dividends is lower than the fixed ROI,

the investors can choose to obtain fixed investment return. Equity is

actually only used for avoiding investors from taking the risk.

7-4 , 股权自动转为债权(贷款)的规定:

7-4. Provisions for automatic conversion of equity into creditor's rights (loans):

7-4-1 ,投资时间到期,基金公司没有按照合同规定时间退款,同时没有支付投资收益,并且双方没有通过友好协商解决违约的时候。投资款和投资收益率金,将自动转为基金公司的债权债务。投资人有权利放弃股权身份。

7-4-1. When the investment time expires, the fund company fails to

refund the money within the time stipulated in the contract, and fails

to pay the investment income, and the two parties fail to resolve the

breach of contract through friendly negotiation. Investment funds and

investment yields will be automatically transferred to the fund

company's creditor's rights and liabilities. Investors have the right to

give up their equity status.

7-4-2 ,投资人购买房地产基金公司的投资本金和投资收益金,有权利购买基金公司集团旗下所有关联公司的房屋。房屋价格必须低于市场正常销售价格的 10%。

7-4-2 , Investors purchase the investment principal and investment

income of real estate fund companies, and have the right to purchase

houses of all affiliated companies of the fund company group. The home

price must be less than 10% of the normal market selling price.

7-4-3 ,如果投资人不选择集团旗下房地产的,那么集团旗下的房地产将成为投资购买房地产基金投资人执行违约的标的物。

7-4-3 , If the investor does not select the real estates developed by

the Group, the real estates will be the subject matter of the breach for

the investors who purchased our funds.

7-4-4 ,集团控股公司担保承诺:新家集团作为全球总部公司旗下所有公司承担连带责任,旗下资产将全部作为房地产基金投资人的直接担保。

7-4-4, The Group guarantees that: the New Home Group, as a global

headquarters, will assume the joint liability, and all of its assets

will be used as direct guarantees for real estate fund investors.

新家集团:

New Home Group: www.new99home.com

7-5, 投资房地产基金额外房地产担保方式:

7-5, Realty Funds Investment with Additional Guarantee

根据证券法,任何企业可以通过转让公司股权或者公司股权担保方式融资。根据美国和新加坡证券法规定,公司转让自己的股权进行抵押或者私募股权融资,不需要向美国

SEC 或者新加坡金融管理局申请第三方融资许可证。如果基金公司融资是作为第三方进行的房地产信托基金管理模式,就需要向 SEC

美国证监会或者新加坡MAS

金融管理局申请房地产信托基金经理管理许可证。因为经纪人公司没有超过融资金额的固定资产,无法承担投资人投资风险的赔偿能力。当然持有基金管理许可证,也不代表你的资金投资是安全的,证监会或金融管理局不会承担投资风险担保和赔偿。简单来说,许可证是让从事房地产信托基金经理人的行为尽可能规范,降低投资风险。投资人的风险在于第三方信托基金管理经理人的资产完全没有能力担保和赔偿投资风险,但有资产有项目的房地产私募股权基金,更有抗风险能力和赔偿的能力。

According to the securities law, any enterprise can raise funds by

equity transfer or equity guarantee. According to the securities laws

of the United States and Singapore, if the company transfers its own

equity or raises by private equity is not required to apply for a

third-party financing license from the SEC or the Monetary Authority of

Singapore. If the fund company is financing by management of realty fund

in trust as a third party, it is required to apply for the management

license for realty fund in trust from the SEC or the MAS, due to the

brokerage company has no fixed assets exceeding the financing amount, it

has no compensation ability to bear the investment risks of investors.

Generally, a broker company has a fund management license does not mean

your funds are safe, that SEC and MAS will not undertake any of your

investment risk and compensation. Simply put, the license is to regulate

the behavior of the third party, who engaged in real estate trust, as

much as possible to reduce investment risk. The risk for investors lies

in the fact that the realty fund trust of the third party has no assets

to cover the compensation of investors investment risk. However, the

realty private equity fund with assets and projects have the ability to

resist risks and compensation.

7-5-1,亚洲新加坡房地产基金公司声明:我们向符合条件的投资人转让房地产基金,或以房地产基金担保方式融资,如个人资产达到100万美金或者新加坡币,或者个人年度收入超过 20 万美金或者新加坡币。

7-5-1,Asia SG Real Realty Fund declares that we will raise money from

the eligible investors by transferring equity or equity guarantee, the

eligible investors including the personal assets of $ 1 million USD or

SGD, or personal annual income of $200,000 USD or SGD.

7-5-2, 亚洲新加坡房地产基金公司声明:

7-5-2, Asia SG Real Realty Fund declares that

我们集团是有房地产项目的房地产基金公司。

Our group is a realty fund company with real estate projects.

新家集团是在新加坡登记注册的全球总部公司。www.new99home.com

New Home Group is a global headquarter company registered in Singapore. www.new99home.com

亚洲新加坡房地产基金公司是新家集团旗下在南洋市场的母公司。www.asia-fund.com

Asia SG Realty Fund is the parent company under New Home Group in southeast Asia market. www.asia-fund.com

7-5-3, 投资购买亚洲新加坡房地产基金额外房地产担保的声明:

7-5-3, Declaration of Investing Asia SG Realty Fund with Additional Property Guarantee

虽然房地产基金公司股权担保已经是最标准的担保模式,但是鉴于部分基金投资人对证券法和金融管理投资法律不熟悉,因此,我们声明我们可以用集团公司及旗下项目公司的房地产进行担保,但不接受抵押房地产担保,因为项目正在申请银行建筑贷款,如果项目资产被抵押将无法申请建筑贷款。投资购买房地产基金的资金额度很小,而集团房地产项目或房屋资产价值很高,那么基金公司进行股权担保,集团公司再担保,再加上集团旗下项目房地产担保,相当于这是一个有

3 重担保的投资。这在房地产基金投资中是非常罕见的超级担保,重复担保的模式。

Although equity guarantee

of realty fund companies has been the most standard guarantee mode, in

view of the fact that some fund investors are not familiar with

securities law and regulations of financial management and investment,

we declare that we will use our Group and the real estates of project

companies under the Group to provide guarantee to the investors,

excluding the guarantee with real estates mortgage. We are applying for

the construction loan, if the project assets are mortgaged, the

construction loan will be unable to approved. The amount of investors’

capital in our realty fund is small, while the value of our Group and

the project assets of the Group is high, then the fund company

guaranteed with equity, the Group re-guaranteed plus the guarantee of

real estates under the Group's projects, equals to an investment with

three guarantees. This is a very rare super-guarantee, repeated

guarantee model in the realty fund investment.

7-5-4, 集团旗下房地产额外担保的规定:

7-5-4, Guaranteed with Real Estates of the Group

(1), 洛杉矶长滩项目现房担保方式:

(1), Guaranteed with Completed Condo of Long Beach Project

担保价值按照房屋销售价值担保。WWW.LONGBEACHGARDENHOME.COM

The guarantee value of realty fund shall be in accordance with the sales price of condos. WWW.LONGBEACHGARDENHOME.COM

房地产基金投资人签订房屋购买协议后,开发商将购买协议发给政府指定办理产权交易的第三方Escrow公证公司办理产权登记手续(OPEN

ESCROW),该流程为产权意向交易,但并没有进行产权交易。在投资期满,且投资人收到退款及全部投资收益后,购房人(房地产基金投资人)需要配合签字取消

OPEN ESCROW产权意向交易的登记手续。

After the realty fund investors signing the

Housing Purchase Agreement, The developer will send the purchase

agreement to Escrow Notary Company, a third party designated by the

government to handle property rights transactions, for property rights

registration (open Escrow). This process is the property rights

intention transaction, but not property rights transaction. After the

expiration of the investment period and the investors receives the

refund and all investment income, the buyers (realty fund investors)

shall assistant in transacting the procedure of cancellation of property

rights intention.

(2), 用夏威夷 26 层楼的项目担保。项目计划于 2023 年 6 月开工,可以预售。房地产基金担保价值将按预售价格的30%担保。请浏览项目网站:www.alamoana-condo.com

(2), Guaranteed with Hawaii 26-story Project. The project which is

expected to be started in June 2023 can be presold. The guarantee value

of the realty fund shall be in accordance with 30% of the presale price

of condos. Please visit: www.alamoana-condo.com.

(3), 夏威夷 40 层楼项目担保。项目计划 2023 年 12 月开工,可以预售。房地产基金担保价值将按预售价格的30%担保。请浏览项目网站:www.alamoana-home.com.

(3), Guaranteed with Hawaii 40-story Project. The project which is

expected to be started in December 2023 can be presold. The guarantee

value of the realty fund shall be in accordance with 30% of the presale

price of condos. Please visit: www.alamoana-home.com.

(4), 洛杉矶万丽花园项目担保金额。项目计划 2023 年 8 月开工,可以预售。房地产基金担保价值将按预售价格的30%担保。请浏览项目网站:www.usafw.com.

(4), Guaranteed with Valley Garden Project. The project which is

expected to be started in December 2023 can be presold. The guarantee

value of the realty fund shall be in accordance with 30% of the presale

price of condos. Please visit: www.usafw.com

(5), 如果房地产基金投资人,在

2023 年 3-5 月期间可以一次性投资超过 6000 万美金的,投资时间 4 年,股权投资,我们愿意用夏威夷两个项目

30%的股份做担保。我们保证投资金额 6000 万美金,4 年项目利润为3000 万美金。同时新家集团公司重复担保。WWW.NEW99HOME.COM

If realty fund investors can invest more than $60 million in a lump sum

within March to May 2023, for equity investment, with the investment

period of 4 years, we're willing to guarantee with 30% equity of the two

projects in Hawaii, that an investment of $ 60 million, a project

profit of $ 30 million in four-year, and plus the re-guarantee of New

Home Group. www.new99home.com

8,私募股权投资人与控股人的责任与权力

8,Responsibilities and Powers of Private Equity Investors and Shareholders

8-1,认购私募股权的投资人是有限责任投资人 LP

8-1 , The investors who subscribe for private equity are the limited investors/partners.

8-2 ,开发商,亚洲新加坡房地产基金是项目控股人 GP

8-2 ,The developer - ASIA SG REALTY FUND is the projects controller/GP.

8-3 ,私募股权投资人不承担项目投资经营过程中的任何责任,同时没有经营管理权力,没有决策权力。

8-3 ,The private equity investors do not assume any responsibility

during the investment and operation of the project, and have no

operation and management power and decision-making power.

8-4

,亚洲新加坡房地产基金是集团以及集团旗下所有项目的实际控股人、责任人;是项目发起人也是项目最大受益人;是经营管理人以及经营管理过程中的决策人;有合同协议的签署权、房地产销售权、股权转让权;有银行贷款、基金公司融资、股权私募融资及投资移民融资的权利。

8-4,ASIA SG REALTY FUND is the actual shareholder and person in

charge of the Group and all the projects under the Group; is the

projects sponsor and the biggest beneficiary of the projects; the

manager and the decision maker in the management process; have the right

of signing the contract and agreement, real estate sales and equity

transfer; and have the right of loan from banks, fund company financing,

private equity financing and investment immigration financing.

9,房地产基金投资风险评估:

9,Investment Risk Assessment of Realty Fund:

9-1,房地产是最具备抗通货膨胀的产品。

9-1,The real estate is the most anti-inflation product.

9-2, 房地产依然还是高利润行业。

9-2, Real estate is still a highly profitable industry.

9-3, 美国政府提高利息遏制房地产价格上涨是因为投资房地产回报率高。

9-3, The U.S. government raised interest rates to curb the rise in real

estate prices because of the high return on investment in real estate.

9-4, 中国政府限制了以投资为目的的购房。因为在过去 20 年里,中国房地产市场造就了很多千万富豪,大部分是投资房地产。

9-4, The Chinese government has restricted home purchases for

investment purposes. That's because over the past two decades, China's

property market has created many multimillionaires, mostly in real

estate.

9-5, 新加坡政府提高外国人购买房地产的额外印花税。因为新加坡是亚洲最安全的国家,亚洲富人的天堂。

9-5, Singapore's government has raised extra stamp duty on property

purchases by foreigners. Because Singapore is the safest country in

Asia, the paradise for the rich in Asia.

9-6,

房地产基金投资风险非常小,因为政府遏制房地产市场,正说明在这个国家或这个区域投资房地产是最容易赚钱的行业。房地产投资是最传统的投资方式,也是最容易最稳定的赚钱方式。而投资房地产基金,使投资房地产变得更灵活,投资金额可以根据投资人的经济实力可大可小。特别是投资有固定收益的房地产基金,投资风险更小。当然,我们需要符合条件的合格投资人。

9-6,The realty fund investment has very low risk due to the

government's crackdown on the real estate market shows that the

investment in real estate is the easiest sector to make money in this

country or this territory. With the most traditional way, investment in

real estate is also the easiest and most stable way to make money.

However, the investment in realty fund is more flexible, the investment

amount can be large or small according to the economic strength of

investors, especially with the fixed ROI, has less investment risk. Of

course, we need qualified investors.

10,房地产基金融资金额和资金用途:

10,Financing Amount and Purpose of Realty Fund:

10-1, 我们计划用房地产基金融资项目总投资的10%-20%,这也是投资房地产私募股权基金风险小的原因之一。

10-1, We plan to use realty fund to finance 10% to 20% of the total

projects investment, which is one of the reasons why investing in realty

private equity fund with less risk.

10-2, 计划房地产私募股权基金融资金额 3400 万-6800 万美金之间。

10-2, The expected financing amount from realty private equity fund is to be $34 million to $68 million.

10-3, 目前夏威夷两个项目和洛杉矶一个项目,总投资金额为 3 亿 4000 万美金。

10-3, Currently, the total investment amount of the three projects, two in Hawaii, one in LA, is to be $340 million.

10-4,

项目已经完成前期投资,购买土地,项目规划,施工图设计。建筑贷款将由银行提供,还有 EB-5

投资人的移民投资款。但中国实行人民币外汇管制,作为EB-5项目在中国市场不好融资。我们集团宁可选择高投资收益的房地产股权私募基金融资,逐步降低中国市场EB-5

投资人的融资。

10-4, Our projects have completed the preliminary

investment, such as land purchase, project planning and construction

drawing design. The construction loan will be provided by banks, as well

as immigrant investment funds from EB-5 investors. However, China

implements RMB foreign exchange control, which makes it difficult to

obtain financing as EB-5 projects in the Chinese market. Our group would

rather financing from realty equity private fund with high investment

returns, and gradually reduce the financing from EB-5 investors in the

Chinese market.

10-5, 房地产基金私募股权融资资金的主要用途:项目经营性费用,如规划、施工图设计、项目管理费用、贷款利息(建筑贷款由银行提供)。

10-5, The main purpose of financing amount from realty equity private

fund: project operating expenses, such as planning, construction drawing

design, project management fees, and loan interest (the construction

loan will be provided by banks).

11, 投资人需知及投资流程

11, Note for Investors and Investment Process

11-1,私募股权投资人电话或者前往办公室咨询。

11-1,Private equity investors consult by call or going to the office.

11-2,浏览网站 www.asia-fund.com 获得投资协议。

11-2,Visit www.asia-fund.com to obtain the investment agreement.

11-3,投资人与我们签订投资协议。

11-3,The investors sign the investment agreement with us.

11-4,双方按照投资协议执行时期。

11-4,Both parties shall follow the investment agreement.

11-5,投资期满,还本付利息,退出投资。

11-5,Upon expiration of the investment period, the principal and

interest shall be repaid and the investment shall be withdrawn.

12,投资协议书

12,Investment Agreement

声明:投资协议将向符合条件的投资人或有意向投资人提供。请符合条件的投资人与我们联系!

Note: The investment agreement will be provided to the investors who

are eligible or have the intention. Qualified investors please contact

us.

13, 集团组织结构图:

13,Group Organization Chart:

亚洲新加坡房地产基金是新家集团 100%投资控股的新加坡母公司。新家集团旗下有 3 个房地产基金公司,基金公司作为母公司是专门为旗下子公司的房地产开发项目融资。

The Asia SG Realty Fund is the Singapore parent company of 100%

investment holding of New Home Group. There are 3 realty fund companies

under New Home Group. As the parent company, the fund company is

specialized in financing for the real estate development projects of its

subsidiaries.

新家集团在新加坡登记注册,新家集团是全球总部控股公司。

New Home Group is registered in Singapore and is a global headquarters holding company.

新加坡、马来西亚、香港的投资计划,请访问:www.new99home.com

For the investment plan in Singapore, Malaysia and Hong Kong, please visit: www.new99home.com

Contact: Johnson FANG

Cell: 808-800-4999

Add: 27 NEW INDUSTRIAL ROAD, #01-01 NOVELTY TECHPOINT, Singapore 536212